See Our Latest Blogs

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Integer ex dui, pellentesque sit amet mi et

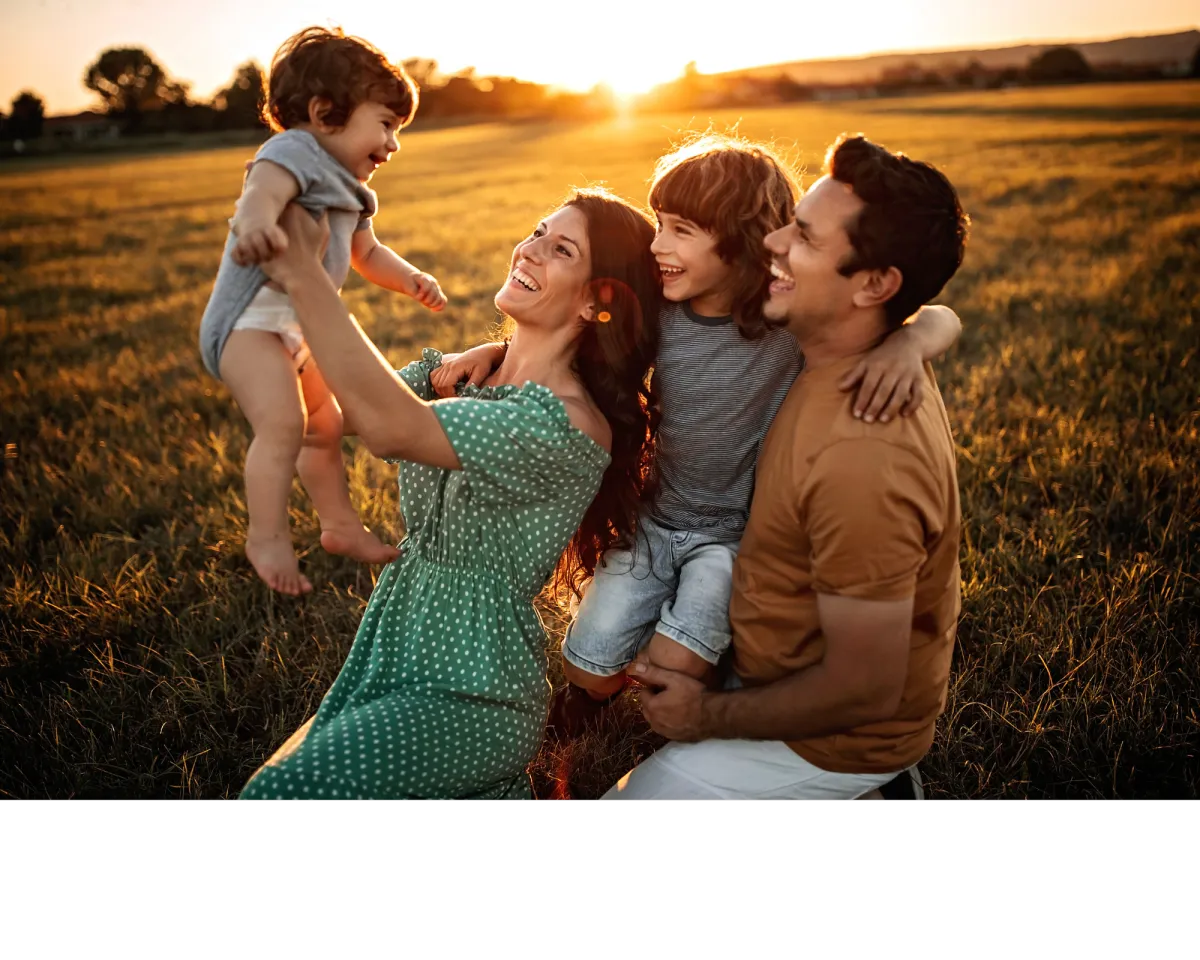

The Importance of Life Insurance: Protecting Your Family's Future

The Importance of Life Insurance:

Protecting Your Family's Future

Introduction:

Exploring the fundamental role of life insurance in securing your family's financial future and why it's a crucial component of any comprehensive financial plan.

Key Points:

Understanding the Purpose of Life Insurance: Discuss the primary reasons why individuals invest in life insurance, including income replacement, debt coverage, and legacy planning.

Types of Life Insurance: Explore the various types of life insurance policies available, such as Term Life, Whole Life, and Universal Life, and help readers determine which one aligns with their needs.

Factors Influencing Premiums: Explain the factors that impact life insurance premiums and offer tips on how to obtain the most cost-effective coverage.

Importance of Regular Reviews: Stress the importance of reviewing and updating your life insurance policy to ensure it remains aligned with your evolving financial goals.

Life insurance is a financial tool that often comes with a myriad of questions and uncertainties. Why do I need it? What type should I choose? How much coverage is enough? While the answers to these questions can be complex, the fundamental role of life insurance is quite simple: it's about securing your family's financial future. In this article, we'll explore why life insurance is a crucial component of any comprehensive financial plan and break down some key points to help you make informed decisions.

Understanding the Purpose of Life Insurance

At its core, life insurance is about providing a safety net for your loved ones in the event of your passing. It's a promise that ensures financial security when you're no longer there to provide for your family. Here are three primary reasons why life insurance matters:

Income Replacement: If your family relies on your income to cover daily expenses, mortgage payments, education costs, or any other financial obligations, life insurance can replace that income, ensuring that your loved ones can maintain their standard of living.

Debt Coverage: Life insurance can help settle outstanding debts, such as a mortgage, car loans, or credit card balances. Without it, your family might be burdened with these financial obligations.

Legacy Planning: Life insurance isn't just about the present; it's also a tool for shaping your legacy. You can use it to leave behind a financial gift, contribute to your children's education, or support a charitable cause close to your heart.

Types of Life Insurance

The world of life insurance offers a variety of policies to choose from, and the right one for you depends on your unique needs and goals. Here's a brief overview of the main types:

Term Life Insurance: This type provides coverage for a specific term, such as 10, 20, or 30 years. It's often the most affordable option and suitable for temporary needs, like income replacement during your working years.

Whole Life Insurance: Whole life insurance offers lifelong coverage and includes a cash value component that grows over time. It's an excellent choice if you're looking for permanent protection and a potential source of savings.

Universal Life Insurance: Similar to whole life, universal life insurance offers lifetime coverage and a cash value component. However, it provides more flexibility in premium payments and death benefit adjustments.

Factors Influencing Premiums

Life insurance premiums can vary widely depending on several factors, including:

Age: Typically, the younger you are when you purchase a policy, the lower your premiums will be.

Health: Your health and medical history play a significant role. Better health often translates to lower premiums.

Coverage Amount: The more coverage you need, the higher your premiums will be.

Type of Policy: Different types of policies come with different cost structures.

To obtain the most cost-effective coverage, it's essential to work with an insurance professional who can help you find the right balance between coverage and affordability.

Importance of Regular Reviews

Life changes, and so should your life insurance policy. As you reach different milestones in your life, like getting married, having children, buying a home, or planning for retirement, your insurance needs may evolve. That's why it's crucial to conduct regular reviews of your policy. Periodic check-ins with your insurance agent can help ensure that your coverage aligns with your ever-changing financial goals and circumstances.

In conclusion, life insurance is not just a financial product; it's a promise to protect your family's future. By understanding its purpose, exploring the types of policies available, managing premiums wisely, and ensuring your policy adapts to your evolving life, you can secure the peace of mind that your loved ones deserve. Remember, it's not about planning for the end but preparing for a future where your family can thrive even in your absence.

Driving Growth, Amplifying Impact

George Owens

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Quisque nisi nunc, tincidunt non nibh non, ullamcorper facilisis lectus. Sed accumsan metus viverra turpis faucibus, id elementum tellus suscipit. Duis ac dolor nec odio

Kim Wexler

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Quisque nisi nunc, tincidunt non nibh non, ullamcorper facilisis lectus. Sed accumsan metus viverra turpis faucibus, id elementum tellus suscipit. Duis ac dolor nec odio

James Cart

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Quisque nisi nunc, tincidunt non nibh non, ullamcorper facilisis lectus. Sed accumsan metus viverra turpis faucibus, id elementum tellus suscipit. Duis ac dolor nec odio

Get In Touch

Email:

Address

Office:

10115 Senate Dr

Lanham, MD 20706

United States

Assistance Hours

Mon – Sat 9:00am – 8:00pm

Sunday – CLOSED

Phone Number:

202-892-0055